Less stress, more payments: automate debt recovery with AI assistants

Even in 2025, late payments remain a critical issue disrupting cash flows and threatening business growth worldwide.

According to recent research by Atradius, over 50% of all B2B invoices are currently overdue in the US, UK and Asia. Barclays reports this figure stands at 58% in the UK, exceeding 60% in some Asian markets.

Research from Intuit and the UK Department for Business and Trade reveals SMEs are owed £27,000 on average in late payments – representing an alarming 27.4% increase since 2021.

Data from Sage and The Data Foundry shows that over the past 15 years, more than 40% of all credit sales fail to be paid by agreed deadlines.

For most organisations, debt collection processes remain essential yet simultaneously represent an accounting nightmare – creating excessive manual work and stress for finance teams.

Can debt management be simplified?

Businesses are searching for ways to streamline payment reminders and recover problematic debts. The immediate answer lies in one word: automation.

But what kind? While numerous automated systems exist for sending reminders and tracking debt status, can any truly replace an accountant's personal contact with debtors?

Smart voice assistant – the latest trend in soft debt collection strategies

The answer is yes – through advanced AI–powered agents specifically designed for payment reminders.

This intelligent voice assistant communicates with counterparties as naturally as a human accountant, providing year-round notifications about overdue invoices and obtaining repayment timelines.

Using cutting-edge NLP technology, it understands counterparties regardless of their phrasing. This unconventional approach delivers highly effective, low-cost debt collection.

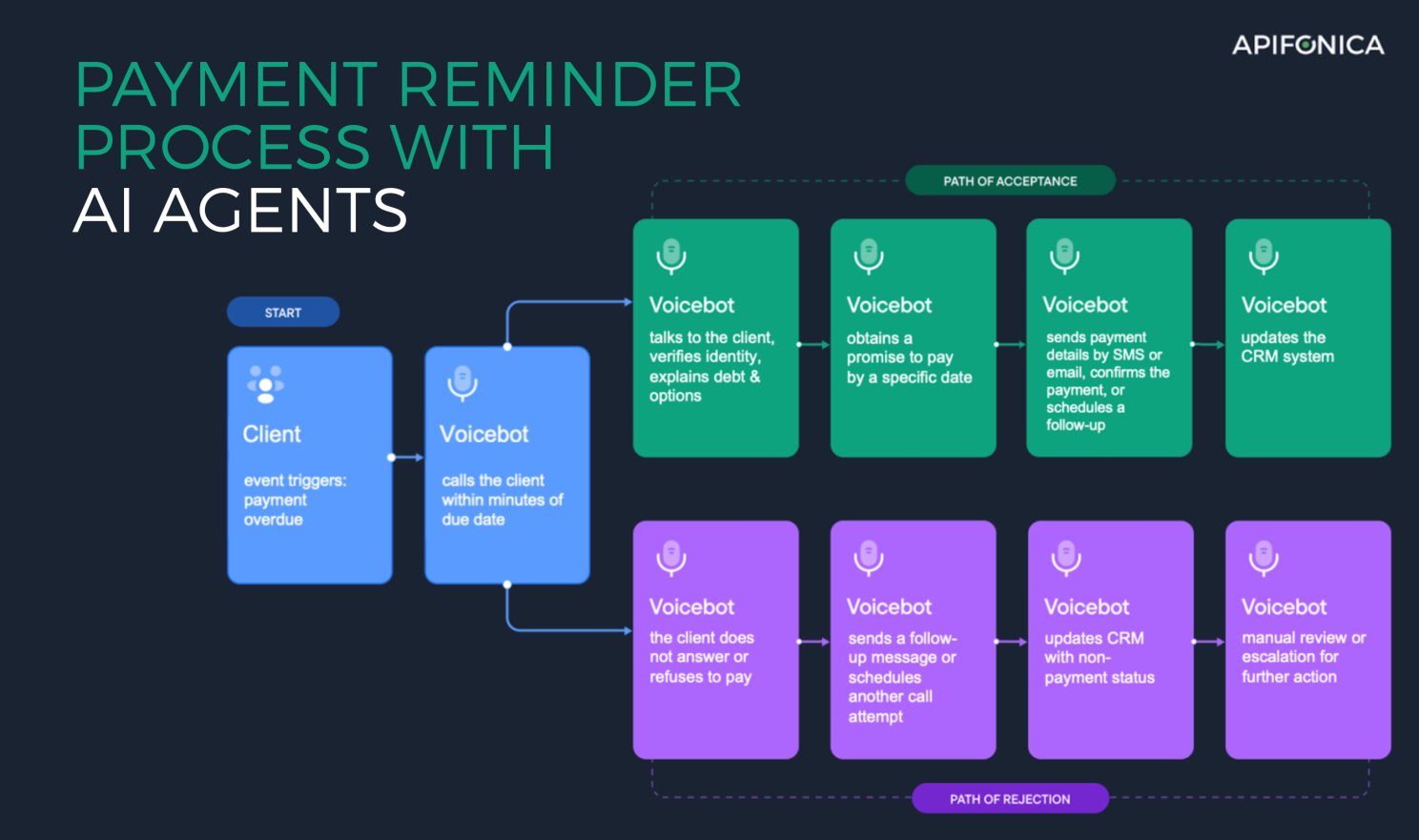

How does a debt collection virtual assistant work?

The operational principle of an agent for automated debt reminders is straightforward and can be explained in a few steps. Here’s how the process works:

The agent regularly calls counterparties with overdue invoices – the frequency can be customised, whether weekly or at other intervals (e.g., less frequently initially, then more often if the debt remains unpaid).

When the agent reaches a counterparty (making multiple attempts if necessary), it:

- Automatically identifies them

- Provides complete payment details:

- Answers any queries

- Requests a repayment date – recording this commitment in the CRM system

Post-call, it sends SMS/email confirmations of agreements. It also messages contacts it couldn't reach by phone, ensuring all debtors receive notification. All agent actions and customer agreements are recorded in the company CRM in real-time.

Key features: 7 reasons to use AI–powered call assistants as automated debt collection software

Let us take a closer look at the features and functions of an agent that addresses common challenges associated with debt collection in business:

1. Operates instantaneously and without interruption

Reminding clients about payments is a meticulous task – it can take many hours, days, or even weeks, with uncertain results. There is often not enough time for this job, and even if time is available, accountants or other staff could use it for tasks more closely related to their core competencies.

While it is not the fault of the company to whom the money is owed, sometimes payment reminders are delayed, causing debts to grow further. In other cases, the very cost of collection increases the outstanding debt. The use of an agent solves this problem – what might take an accountant an eternity to complete, the agent does instantly and effortlessly – completely automatically. It can handle up to 5,000 conversations simultaneously! That is a significant saving in both time and money.

2. Communicates freely with people

An agent communicates with counterparties almost as fluently as an accountant – understanding various forms of expression (regardless of the wording used) and responding to a wide range of questions.

For example, imagine it is Monday 6th May, and the agent calls a client. In response to a question about the repayment date, the client might say, ‘I will pay within a week’, ‘the payment will be made by 13th May’, or ‘I need another seven days to pay’. The agent will correctly interpret these intentions and record 13th May as the promised payment date.

How does an agent understand people? The core lies in its use of NLP – Natural Language Processing – an advanced artificial intelligence technology that analyses human language, understands intent, and learns from further interactions and experience.

3. Clear and calm

It is undeniable that debt collection and discussions about financial obligations are unpleasant activities, for both creditor and debtor.

The agent helps overcome this psychological barrier: it is always polite and remains calm and collected, while people generally find it easier to speak with a machine about such a delicate matter as their debts.

4. Calls until it gets through

Debt collection often involves repeated attempts to reach a counterparty, who may be reluctant to answer or may keep postponing the conversation ‘indefinitely’.

The agent does not give up: it makes multiple calls at set intervals, carrying out a predetermined number of attempts. If the counterparty persistently fails to answer or if the number is invalid, this information is automatically recorded in the system.

5. Misses nothing

In the busy flow of invoices and business, it is easy to overlook an unpaid invoice, only to remember it when the debt has already become overdue.

But there is a solution! The agent, being a machine, does not make the typical human errors – if properly programmed, you can be certain that it will not forget anything.

6. Keeps documentation organised

Another time-consuming aspect of debt collection is entering information into the CRM system: the status of the debt, the client’s promised repayment date, the content of the conversation with the counterparty, and so on.

The agent takes care of this as well – it is integrated with many CRM systems and over 2,000 different services, automatically updating data in your records after each call.

7. Implementation takes just a few days

It is also worth mentioning that a debt collection agent can be implemented within just 3–5 days – complete with all essential features such as editable standard templates, a built-in toolkit for speech synthesis and recognition, SMS support, a local phone number, and basic reporting.

Blah blah blah – show me an example of debt automation!

Of course, everything sounds excellent in theory. But how does the agent perform in real-life interactions with customers? Let’s explore a real-world example of a conversation between our automated assistant and a customer, provided in the audio recording below.

It's worth noting that it’s impossible to predict exactly how a customer might react or what objections they’ll raise (this will be covered in a separate article). That’s precisely why our virtual agent is prepared for various scenarios and queries. During a call, it can:

- Recognise and introduce itself clearly to the customer.

- Explain the purpose of the call and inform the customer about an outstanding debt.

- Calmly and effectively address initial objections such as: "Who are you?", "How did you get my number?", or "Why exactly are you calling me?".

- Arrange to call back at a more suitable time if the customer can't talk immediately, even specifying preferred times.

- When necessary, it can call from different numbers to improve the chances of connecting successfully.

- After informing the customer about their debt, it proceeds to handle further objections by offering practical solutions such as discounts, instalment options, or extending payment deadlines.

- Additionally, the voice assistant can automatically send an SMS during the conversation, including a convenient link to help the customer quickly and easily resolve their outstanding balance.

Let’s break the process down step by step. Here, we’re dealing with the case of a client’s ex-wife, who left him €700 out of pocket after spending that amount on his card. Unfortunately, the responsibility for settling the debt still lies with the client.

See how the debt recovery process works in a real-life example

Automated debt collection process – does it really work?

An agent “hired” for permanent work in a company will collect debts year-round – thanks to this, the accounting department (or other employees who previously handled this) will gain significant time and eliminate stress.

But this isn’t just pure theory – a good example is our client case, the international retail chain Leroy Merlin, which implemented agent Patrycja into their debt collection process.

The main problem was that too much time was being spent reminding about overdue invoices. As a result of the agent's actions, there was an increase in recovered (and timely!) payments, while employees could focus on their key tasks.

Want to know how to implement a similar solution and how it works? Have a no-obligation conversation with our expert who will answer your questions.