Saving hundreds of thousands with debt collection AI agents

Late payments are a headache for nearly every business – from banks and retail chains to online services and subscription platforms. The larger the customer base, the more unpaid invoices, overdue credit cards, and forgotten debts pile up.

In recent years, there's been a noticeable shift: companies are no longer just increasing the size of their collections teams – they’re looking for smarter solutions. Automation in debt collection is no longer a futuristic concept; it's becoming a necessity.

In this article, we’ll show you how an agent can hold real conversations with debtors – not just reading out scripts, but actually understanding replies, handling objections, and guiding people towards payment. We’ll also break down how it’s integrated, what scenarios it follows, and – most importantly – how much time and money it can save.

A real case in action: from conversation to cost reduction

One of the most striking aspects of an agent’s performance is its ability to hold a genuine conversation with a debtor. Unlike basic robocallers that simply read out scripted text, this agent engages in a flexible, adaptive dialogue, responding naturally to the tone and replies of the person on the other end.

The script is designed to guide the entire journey – from the initial greeting to the debtor agreeing to make a payment or arranging an in-person visit.

The conversation begins with a polite introduction:

“Hello, this is your personal assistant from Reliable Bank, Anna. May I speak with Michael Williams?”

The agent waits for identity confirmation. Even if the response is vague or emotional, the agent remains composed and consistent:

“Just woke me up. Who is this?” “This is Reliable Bank. May I speak with Michael Williams?” “Yes, this is Michael. What’s this about?”

Once the identity is verified, the AI agent gets straight to the point:

“I can see that you have an outstanding balance of 700 dollars, which has been overdue for 32 days. I’d like to help you resolve this quickly. Are you planning to make a payment soon?”

At this stage, objections are common. In a real call, the customer responded:

“That’s not my debt – it belongs to my ex-wife. She’s already paid it off.”

The AI agent doesn’t argue or apply pressure, but responds calmly and clearly:

“I understand. However, since the card is registered in your name, the payment is still required. When would you be able to make it?”

If the customer agrees to pay, the agent offers suitable options:

• Whether payment can be made immediately, and for what amount.

• A three-month instalment plan, if needed.

• If even that is difficult, a 12-month plan is possible, but would require a visit to the branch and signing a new agreement in person.

The agent offers the addresses of two nearby branches, and the customer chooses what’s convenient:

Customer: “I can go to the office at 5 River Road.” Bot: “Great. I’ll pass this on to our manager and connect you now to confirm the appointment.”

The agent then transfers the call to a live agent – but not before summarising the key points of the conversation: who the customer is, what the issue was, what they agreed to, and what next step was selected. All of this happens automatically, without needing a human to collect or re-explain the details.

Crucially, the scenario is built to handle dozens of possible customer reactions. The agent can interpret statements like “Now’s not a good time,” “I don’t know what this is about,” or “You’ve got the wrong number.” It doesn’t get stuck, and it doesn’t repeat the same line over and over – it adapts its responses based on the context.

Moreover, the entire script is designed to be legally sound. The agent doesn’t accuse, threaten, or make absolute claims. It maintains a tone of polite, service-oriented communication – which is especially important for banks and financial institutions.

Let’s watch a quick video:

The technology behind it: how the AI in debt collection actually works

During our product demos, we don’t just play call recordings – we also show the platform where the entire debt collection scenario is built. It’s a visual editor, where each part of the conversation is represented as a block, connected by logical flows.

The main building blocks:

- Green blocks are question bricks. These are points where the AI agent asks the user a question and waits for a response.

- Grey and purple blocks handle technical and support functions – integrations, metric tracking, or control flow within the scenario.

- Each block has its own settings, including the speech recognition and interpretation methods used inside it.

As we demonstrate, each question block uses a three-level system to interpret the user’s response. This allows the agent to understand not only clear “yes” or “no” answers, but also vague, emotional, or informal replies – the kind that would break a traditional IVR system.

Three levels of response analysis:

- Direct match keywords. The classic approach. If the user says an exact, expected phrase (like “yes”, “that’s me”, or “no”), the agent immediately acts on it. This is essential in legally sensitive situations, where decisions must be based on explicit confirmation.

- Intent detection. If no direct keyword is found, the agent looks at the intent behind the phrase: is it positive, negative or neutral? This helps catch responses like “I just woke up, who even is this?” – which, while rude, still implies “yes, I’m the right person”.

- GPT fallback. If both previous layers fail, the AI agent activates a GPT-powered fallback. Each block includes a predefined prompt that outlines the agent’s question, the expected answer, and how to interpret ambiguous replies. GPT can then rephrase the question, ask for clarification, or steer the conversation – all without sounding robotic to the customer.

Example from a demo:

Bot: “May I speak with Michael Williams?” Customer: “You woke me up, who even is this?” GPT kicks in – the agent rephrases the question more softly. Customer: “Yeah, that’s me.”

Thanks to this layered structure, the agent never freezes, loops endlessly, or drops the call. It moves conversations forward – either towards a payment agreement, or a smooth handover to a live agent.

The platform also allows us to replay calls, view detailed stats, identify where users tend to drop off, and quickly adjust the scenario – all without needing developers.

Integration and setup: how it all gets started

During our demos, we emphasise that the AI agent is not a one-size-fits-all solution – it’s a flexible tool that adapts to the client’s specific business processes.

Integration with CRM and data sources

The first step is to connect the client’s infrastructure. This is done via a webhook request that pulls in the necessary data from the CRM system:

- who needs to be called,

- the customer’s name,

- the amount of debt,

- the number of days overdue.

As a result, the agent starts each call already “in the know” – the conversation is personalised from the very first second.

For example, when a call is initiated, a webhook fetches data from the CRM, and based on those values, the agent decides which route to take in the scenario. A different dialogue might be used if the debt is over 30 days old compared to more recent cases.

Scenario logic before the call even begins

Before the call starts, the agent applies pre-set rules to determine the appropriate communication path. For debts under 30 days, the script might take a softer tone. For older debts, it may use firmer language. All of these logic conditions can be set in the visual interface – no coding required.

Time to launch

• Scenario development typically takes around 10 working days. This includes scripting, designing logic flows, fallback handling, and testing.

• CRM, telephony and API integration takes an additional 5 to 10 working days, depending on the complexity of the client’s systems.

This means that, in most cases, the first live calls can be launched within 2 to 3 weeks from the start of the project.

Background noise simulation: making it feel real

One unique feature of the platform is the ability to add subtle background noise – like a quiet office hum – so the AI assistant doesn’t sound overly synthetic. It creates the impression of a real call centre agent speaking.

This small detail makes a big difference. In the context of debt collection, where trust and authority are key, it helps ensure that customers don’t even realise they’re speaking with a bot – which increases both engagement and payment conversion.

The economic impact: how a robotic agent saves hundreds of thousands of euros

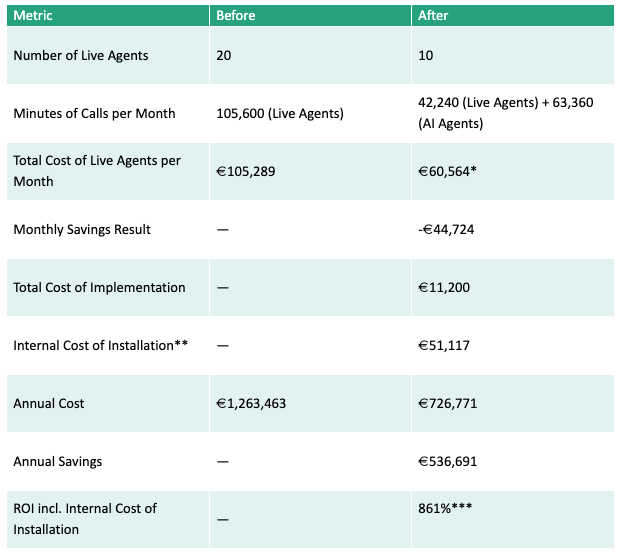

To understand the real impact of an agent on your business, it's important to look beyond the conversation flow – and dive into the numbers. The table below compares two scenarios: 40% and 60% call automation, while keeping the team size fixed at 12 agents. It includes not only staffing costs, but also the cost of the agent, implementation expenses, and the potential savings.

As the data shows, even partial automation can deliver monthly savings of tens of thousands of euros – and annual savings that easily reach into the hundreds of thousands. What’s more, the return on investment is measured in weeks, not months.

How do we optimise call center operations after integrating AI 60% into the process?

Note: The data presented in this table is based on a simplified, template scenario. Actual figures may vary depending on your specific call volumes, team structure, and implementation requirements. This table is provided for illustrative purposes only.

* €52,644 (Live Agents)+€7,920 (AI Agents) | ** Cost of live agents working time spent on integration | *** 536,691/(51,117+11200)

Now imagine your call centre doesn’t have 20 agents – but 50, or even 600. The scale of potential savings becomes truly substantial.

How efficient is a human agent, really?

Even under optimal conditions, a call centre agent’s day is far from 100% efficient. Based on the figures above, each of the 12 agents handles around 5,280 minutes of talk time per month. That’s roughly 240 minutes per day – or just 30 minutes of talk time per hour.

And that’s compared to a maximum possible of 45 minutes of conversation per hour (the remaining 15 minutes go to breaks, notes, system updates, and transitions).

In other words, the average agent operates at about 66% efficiency relative to their theoretical maximum. That’s expected, but it also explains why even partial automation can significantly boost team productivity without increasing headcount.

When an agent handles a portion of the call volume, the remaining human agents can be redirected towards more complex or sensitive cases, where empathy, judgment, or sales skills are needed. The rest can be automated.

Why everyone wants our demos

At our presentations, we don’t overwhelm clients with slides or abstract theory. Instead, we go straight to what matters: demonstrating how the agent actually works – using real recordings from real conversations. These aren’t scripted samples, but genuine calls with real people, full of emotion, hesitation and unpredictability.

While the recording plays, we also share the visual call flow – a live view of how the AI agent moves through each block of the scenario. We show where it picks up keywords, when GPT kicks in, how it adapts to ambiguous answers, and how the logic is structured behind the scenes. This transparency helps clients understand that they’re not seeing magic – they’re seeing a precise, manageable system.

And it works. Clients usually grasp the concept within minutes. Often, we don’t even need to run a live session – the combination of authentic audio and interactive visualisation speaks for itself.

Our demos are appreciated for being clear, practical, and grounded in reality. There’s no need to rely on assumptions or vague promises – everything can be seen, heard, and tested. That builds trust and shifts the conversation from abstract discussion to concrete implementation. It’s the reason people leave our demos thinking: we’ve seen exactly how this works.

When you don’t want to waste time

Sometimes, it becomes clear before the demo is even over. You hear how it works, listen to real calls, run the numbers in our calculator – and the decision practically makes itself. All that’s left is to get the system live as quickly as possible.

We’ve designed the onboarding process to be as simple as possible. Right after the meeting, we send a tailored commercial proposal – with pricing, projected savings, and estimated timelines. Alongside that, we include call recordings, screenshots, and the full presentation deck so your internal team can review everything at their own pace.

We usually suggest a follow-up meeting in a week’s time – after you've had a chance to go through the materials and prepare feedback. If you're ready to move forward, we request a sample of 500 to 1,000 of your real recorded calls. This helps us understand your typical scenarios and identify what can be automated.

In parallel, we hold a technical session with your IT team to discuss CRM, telephony, and system integrations. Within 5 to 10 working days, we return with a final proposal – including exact costs, a recommended plan, and timeframes for go-live.

From there, it’s simple: approval, contract, and launch. And if you don’t want to waste time – neither do we. Our onboarding calendar can fill up quickly, so it’s worth locking in your timeline early.

Conclusion

Debt collection today isn’t just about numbers – it’s about technology, scalability, and how you treat your customers. The industry is evolving, and the era of pushy agents is coming to an end. In their place, agents are emerging that can actually hold a conversation – and do it well.

We’ve shown how our approach works: from dialogue scripts to technical integration, from real audio to financial results. This isn’t theory – it’s something that’s already helping businesses cut costs, boost efficiency, and automate complex, repetitive work.

And if you’ve read this far – there’s a good chance you’re genuinely interested. In that case, it’s simple: give us 30 minutes, and you’ll hear it for yourself. Have a no-obligation conversation with our expert who will answer your questions.